Swing trading in the Forex market offers traders an opportunity to capitalize on short-to-medium-term price movements. This type of trading combines technical analysis, market trends, and risk management to help traders achieve their financial goals. If you’re interested in entering the world of Forex swing trading or looking to improve your skills, this guide will equip you with essential knowledge and strategies. Moreover, consider using a reliable platform like swing trading forex LATAM Trading Platform for your trading activities, ensuring a seamless experience and access to advanced tools.

Understanding Swing Trading

Swing trading is a strategy that seeks to capture price movements within a specific time frame. Unlike day trading, where positions are opened and closed within the same trading day, swing traders typically hold positions for several days or even weeks. This allows traders to take advantage of price “swings” and capitalize on changes in market sentiment and economic data.

Key Characteristics of Swing Trading

- Time Frame: Swing trades usually last anywhere from a few days to several weeks.

- Technical Analysis: Swing traders often rely on charts and indicators to identify potential entry and exit points.

- Risk Management: Proper risk management strategies are crucial for long-term success.

- Flexibility: Swing trading allows for flexibility in both strategy and time commitment compared to day trading.

Essential Strategies for Swing Trading Forex

Developing effective strategies is critical for success in swing trading. Below are some strategies and tips to help you increase your chances of success in the Forex market.

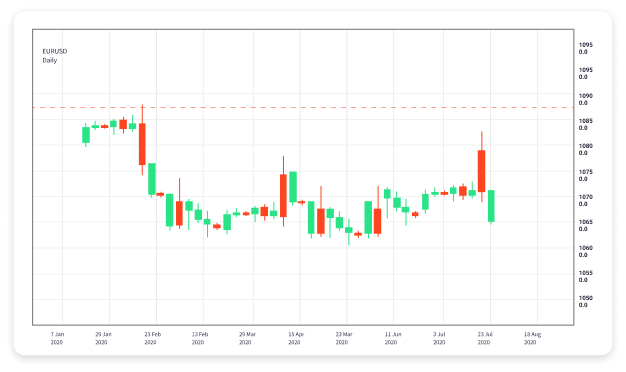

1. Identify Trends

Understanding market trends is fundamental to swing trading. Traders should look for upward trends (bullish) or downward trends (bearish) using various charting techniques. Moving averages, trend lines, and Fibonacci retracement levels can help in identifying these trends. Typically, swing traders will enter trades in the direction of the trend to increase the probability of a favorable outcome.

2. Use Technical Indicators

Technical indicators are essential tools for swing traders. Some popular indicators include:

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements. Traders often use it to identify overbought or oversold conditions.

- Moving Averages: Simple Moving Averages (SMA) or Exponential Moving Averages (EMA) can help to smooth out price action and identify trends.

- Bollinger Bands: These bands consist of an SMA and two standard deviation lines. They help traders identify volatility and potential reversal points.

3. Set Entry and Exit Points

Before entering a trade, it’s crucial to establish your entry and exit points. Swing traders should determine where they will enter based on their analysis and set a take-profit level and stop-loss order to manage risk. This ensures that losses are minimized, and profits are maximized. A common strategy is to aim for a risk-reward ratio of at least 1:2.

4. Follow Economic News and Events

Economic events, news releases, and geopolitical events can significantly impact the Forex market. Swing traders should stay informed about upcoming economic data releases and events that could influence market volatility. Calendars tracking such events can be found on financial news websites or broker platforms, and it’s wise to adjust your trading plan around these times.

Risk Management in Swing Trading

Managing risk is paramount in trading. Without a solid risk management strategy, even the best trading setups can lead to losses. Here are a few essential risk management techniques specifically for swing traders:

1. Position Sizing

Position sizing refers to the number of units you will buy or sell in a trade. Determine your risk tolerance and use it to calculate the appropriate position size for your trades. A common rule is to risk only a small percentage of your trading capital on any single trade, often between 1-2%.

2. Use Stop-Loss Orders

Hello

Implementing stop-loss orders is crucial for limiting potential losses. Place these orders at a price level where you would exit the trade if the market moves against you. This helps to protect your capital and maintain discipline in your trading strategy.

3. Diversify Your Trades

Diversification involves spreading your investments across different currency pairs. This can help mitigate risk as various currencies may not move in the same direction at the same time. By diversifying, you can reduce the impact of a poor-performing trade on your overall portfolio.

Common Mistakes in Swing Trading

Despite having a well-defined strategy, many traders make common mistakes that can hinder their success. Being aware of these pitfalls can help you avoid them:

1. Overtrading

Overtrading occurs when traders enter too many trades without proper analysis, often leading to increased transaction costs and emotional strain. Stick to your trading plan and only open positions when you have a high-probability setup.

2. Ignoring News Events

Failing to account for major news events can result in unexpected market volatility. Always check the economic calendar before entering a trade and be prepared for potential impacts on your positions.

3. Neglecting Risk Management

Many traders prioritize potential profits over risk management. Ensure that you have a clear strategy for both entering and exiting trades while protecting your capital.

Conclusion

Swing trading Forex can be a rewarding approach for traders who prefer a strategic and less time-intensive method than day trading. By understanding market trends, utilizing technical analysis, and implementing strong risk management practices, traders can enhance their chances of success. Remember that consistent practice and learning from your experiences will make you a more proficient swing trader. Always consider using a robust trading platform such as the LATAM Trading Platform to access valuable resources and tools for your trading journey.