Comprehensive Guide to Exness Forex Trading

In the modern world of finance, forex trading has emerged as a thrilling avenue for traders around the globe, and exness forex trading Exness Thailand stands out as a prominent platform to consider. Exness is more than just a trading platform; it’s a comprehensive ecosystem designed to help you navigate the forex markets with ease and expertise. In this guide, we will delve into the crucial elements of forex trading with Exness, exploring everything from account creation to advanced trading strategies.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves buying one currency while simultaneously selling another. It is one of the largest financial markets in the world, surpassing even the stock market in terms of volume. Currency pairs, such as EUR/USD or GBP/JPY, denote the relative value of one currency against another. Traders speculate on price movements, aiming for profits based on fluctuations in these currency pairs.

Why Choose Exness for Forex Trading?

Exness has grown to become a popular choice for forex traders, primarily due to its user-friendly interface, support for a wide range of trading instruments, competitive spreads, and reliability. Here are some reasons you should consider Exness:

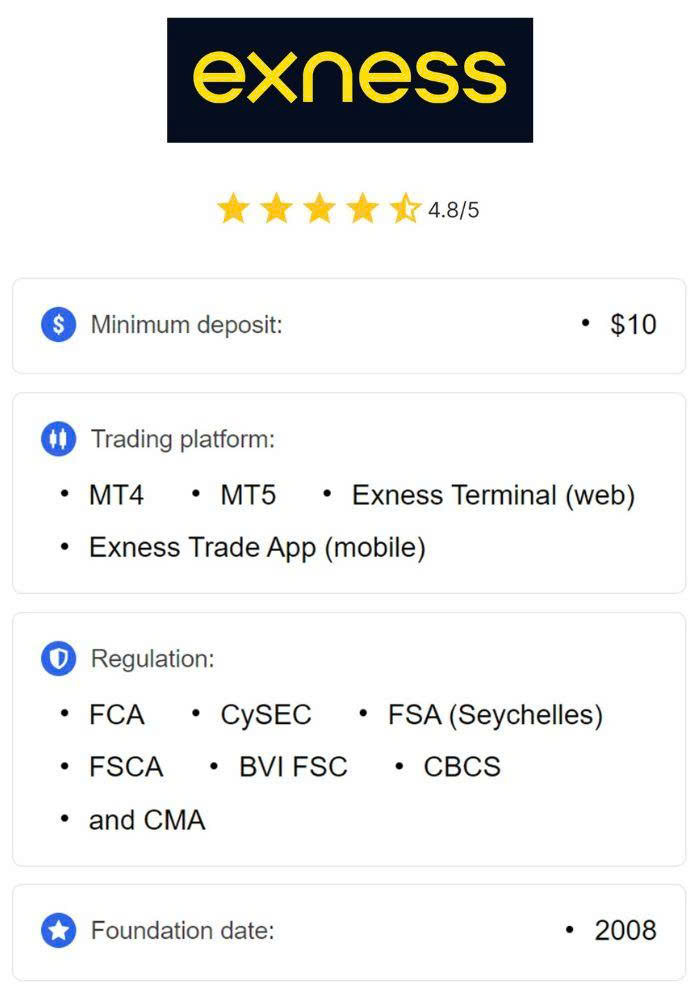

- Regulation: Exness is regulated by several top-tier financial authorities, providing a level of security and trustworthiness that is crucial for any trader.

- Variety of Accounts: Exness offers different types of accounts designed to cater to both beginners and experienced traders. You can choose between several account types based on your trading style and experience.

- Leverage Options: The platform offers flexible leverage options, allowing traders to control larger positions with a relatively small amount of capital.

- Trading Tools: Exness provides a plethora of trading tools, including real-time charts, economic calendars, and analytical features that assist in making informed trading decisions.

Getting Started with Exness

Creating an Account

Getting started with Exness is straightforward. Follow these steps to create your trading account:

- Visit the Exness website and click on the ‘Sign Up’ button.

- Fill in the necessary personal details including your email address and phone number.

- Choose the type of account that best suits your trading needs.

- Complete the verification process by submitting the required documents.

- Fund your trading account using one of the many available payment methods.

Deposit and Withdrawal Methods

Exness offers a variety of deposit and withdrawal options, ensuring that you can easily fund your account and access your profits. Some of the common methods include:

- Bank Transfers

- Credit/Debit Cards

- E-wallets such as Skrill and Neteller

- Cryptocurrencies

Transactions are generally quick, enabling you to start trading almost immediately after funding your account.

Understanding Leverage and Margin

One of the significant benefits of trading with Exness is the powerful leverage that they offer. However, it is essential to understand leverage and margin before diving into trades:

- Leverage: This allows you to control a larger position with a smaller amount of capital. For instance, with a 1:200 leverage, you can control $20,000 with only $100.

- Margin: This is the amount required to open and maintain positions. It is essential to ensure that you have sufficient margin to prevent margin calls and potential liquidation of your trades.

Trading Strategies with Exness

Successful forex trading requires a robust strategy. Here are a few strategies that can enhance your trading performance with Exness:

1. Scalping

Scalping involves making quick trades for small profits. Traders usually hold positions for a few seconds to minutes, making multiple trades throughout the day.

2. Day Trading

Day traders open and close trades within the same day, aiming to take advantage of short-term market movements. The strategy requires constant monitoring of the market.

3. Swing Trading

This strategy involves holding positions for several days or weeks to capitalize on expected market shifts. It’s ideal for those who cannot constantly monitor the market.

4. Position Trading

Position traders hold trades for long periods, focusing on broader market trends. This strategy requires strong analytical skills and patience.

Risk Management in Forex Trading

When trading forex, risk management is crucial for protecting your capital. Here are some tips for effective risk management:

- Set Stop-Loss Orders: This ensures you limit your losses on individual trades.

- Use Proper Position Sizing: Determine the size of each trade based on your overall trading capital and risk tolerance.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade or currency pair.

- Stay Informed: Keep yourself updated with market news and trends to make informed trading decisions.

Conclusion

Exness forex trading provides a robust platform for traders of all levels. With its regulatory compliance, diverse account types, and a wealth of trading tools, it serves as an excellent choice for navigating the forex market. By developing a solid trading strategy, understanding leverage and margin, and implementing strong risk management practices, you can enhance your chances of success. Whether you are a beginner or an experienced trader, Exness can support you on your journey in the dynamic world of forex trading.